It can be difficult to understand how much money you will actually make based on looking at your offered pay rate alone.

This is because there are many things that are taken out of your paycheck almost immediately, affecting the money you will really have available when you go to the bank.

In this post, we’ll show you how to understand how much money you’ll have leftover from your paycheck after paying your taxes and living expenses.

First things first: let’s clarify the vocabulary we’re using!

- Take-home pay: the amount of money that actually reaches your bank account after accounting for taxes.

- Cost of living: the total amount of money required to live in a certain area to cover your basic necessities and expenses (like food, housing, and transportation)

- Discretionary income: The amount of money you have leftover after paying for these necessities. How you spend or save this chunk is up to your “discretion!”

Cost of Living in the US

The “cost of living” in different U.S. cities is determined by weighing these core costs:

- Taxes

- Average rent prices

- Average food prices

Other factors that can contribute to a higher or lower cost of living include:

- The “multiplier effect” of having children, education-related costs

- Transportation

- Health care

- Entertainment

A good rule of thumb is to know that cities with a higher cost of living are more expensive. Food, housing, transportation, healthcare resources, and pretty much anything else will be more expensive than they would be in lower-cost cities. That’s why we want to help you understand how these differences work regarding you and your pay rate.

But how do you calculate what you will actually make, taking all these different cost factors into account?

There are many resources available online, such as “cost of living calculators” and “take–home pay calculators.” One useful tool is the Salary Paycheck Calculator from ADP. This calculator will show you your take-home pay after taxes, but before costs like rent, food, and transportation.

To get a better understanding of how much you might spend after paying your taxes, we’ve used Livingcost.org to estimate the amount you might spend per month on various items. You can simply type your city into one of the search bars at the very top, and click “go.”

Another great cost-of-living estimators can be found at NerdWallet and BankRate.

**Please note, sites like Livingcost.org, NerdWallet, and BankRate can only estimate your costs based on crowd-sourced and researched data. It is up to you to manage your budget and choose what to spend your money on.

Let’s try it!

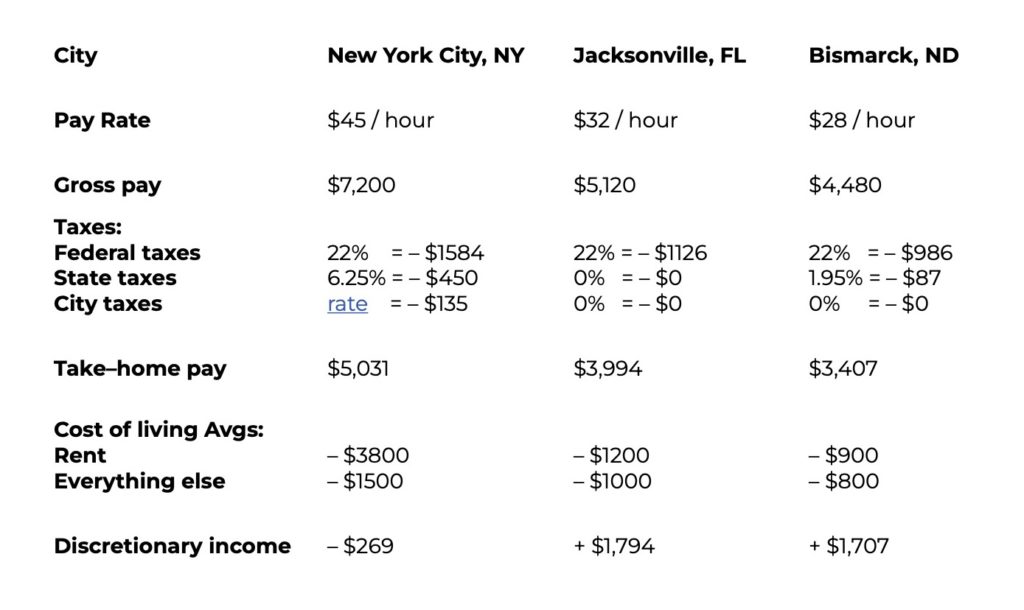

To demonstrate what these differences can look like, let’s compare costs for a nurse in New York City, NY, versus Jacksonville, FL, versus Bismarck, ND.

Monthly Calculations for one person, in 1-bedroom apartment

Notice how your take-home pay still seems bigger in a big city like New York? However, the discretionary income is drastically lower (and non-existent in this case) in New York. This is where a city’s cost of living becomes more important! New York is extremely expensive (tax-wise and essentials-wise), and it depletes this sample bank account for the month. That would be an extremely stressful and difficult budget to manage, compared to Jacksonville or Bismarck, where you’d have necessary income leftover.

Not every expensive city will look exactly like New York, but cities like Los Angeles, Washington D.C., and Dallas have a similar effect on your bank account.

Pay rates around the country can vary widely, because each city and state is so unique. It is up to you to understand where that pay is actually going, before it hits your bank account. Make sure you do your research! If you’re an Interstaff nurse and have questions regarding cost of living and similar matters, please email support@interstaffinc.com.